Phone:

(+65)8319-0742

The scaffolding industry is key in the U.S. construction world. It supports projects all over the country. This report looks at which states use more scaffolding and why. We’ll explore regional construction data, trends, and safety rules to understand the scaffolding market better.

The North American scaffolding market has seen ups and downs. Revenue dropped by 0.3% each year for the last five years, hitting $5.5 billion in 2024. The construction sector’s performance affects scaffolding use. Despite recent hurdles, the market is expected to grow, driven by economic stability and consumer confidence.

As construction grows, so will the need for scaffolding. This opens doors for companies in the industry to grow.

Key Takeaways

- The United States construction scaffolding market was valued at USD 10 billion in 2022 and is projected to reach USD 13 billion by 2030, growing at a CAGR of 3.8% from 2024 to 2030.

- Supported scaffolding remains the dominant segment due to its versatility and wide application across various construction projects.

- The United States scaffolding and accessories market is expected to experience strong growth from 2024 to 2031, with a projected CAGR of XX%.

- Key manufacturers in the United States scaffolding market include Altrad, BrandSafway, Layher, ULMA, PERI, AT-PAC, ADTO GROUP, XMWY, RMD Kwikform, and others.

- Technological advancements and the adoption of lightweight materials are shaping trends in the scaffolding and accessories market.

Scaffolding Industry Overview and Market Size

The scaffolding industry is key in supporting construction projects worldwide. It provides essential access and safety for workers at height. With the global construction sector growing, the demand for scaffolding systems has increased. This has led to a significant expansion in the scaffolding market size in recent years.

Recent market research shows the global scaffolding market was worth USD 53.68 billion in 2023. It is expected to reach USD 90.48 billion by 2033, growing at a 5.36% CAGR. This growth is mainly due to increased investments in infrastructure, industrialization, and urbanization in countries like China, India, and Brazil.

Current Market Performance and Revenue

The scaffolding industry’s revenue has been rising steadily. The Asia Pacific region leads the market, accounting for 36.44% of the global revenue in 2023. The supported scaffolding segment holds a significant market share, providing a secure platform for workers at height.

Aluminum scaffolding is the dominant material, making up about 32.47% of the market share in 2023. It is favored for its lightweight nature, ease of handling, resilience, and versatility.

Projected Industry Growth and Outlook

The scaffolding industry is set to continue growing in the coming years. The North America Scaffolding Market is expected to grow at a 5.0% CAGR from 2021 to 2027. The U.S. is leading the market, with a projected value of $12.9 billion by 2027.

Canada and Mexico are also expected to see significant growth. They are projected to grow at CAGRs of 7.4% and 6.5%, respectively, from 2021 to 2027.

Leading Companies in the Scaffolding Industry

The scaffolding industry is home to several prominent players. These companies drive the market’s growth and innovation. Some of the leading companies include:

- PERI Group

- ADTO Group

- Altrad Group

- Atlantic Pacific Equipment (AT-PAC), LLC

- ULMA C y E, S. Coop.

- MJ-Gerüst GmbH

- Safway Group Holding LLC

- Stepup Scaffold, LLC

- KHK Scaffolding & Formwork LLC

- Wilhelm Layher Holding GmbH & Co. KG

- Waco Kwikform Limited

These companies offer a wide range of scaffolding systems for various construction projects. Their expertise and commitment to safety and innovation drive the industry’s growth.

Factors Influencing Scaffolding Usage Across States

Scaffolding use in the U.S. changes from state to state. This is due to construction levels, rules, and how urban areas grow. These factors greatly affect how much scaffolding is needed in each area, shaping the scaffolding industry.

Construction Activity and Investment

The amount of construction happening in a state affects scaffolding use. States with lots of building projects need more scaffolding. Things like the economy, population, and what people want to buy also play a part.

Regulatory Requirements and Safety Standards

State rules and safety standards also impact scaffolding use. States with strict rules and a focus on worker safety often require scaffolding. This helps keep workers safe and reduces risks from heights.

“Safety is not just a slogan, it’s a way of life. Scaffolding plays a vital role in protecting workers and ensuring compliance with regulations.”

Urbanization and Infrastructure Development

Urban growth and big infrastructure projects also affect scaffolding use. States with fast-growing cities and big projects need more scaffolding. This is because these projects often require scaffolding to work safely at high levels.

As states keep investing in cities and infrastructure, scaffolding demand will likely rise. Scaffolding makers and suppliers need to keep up with these changes to serve the construction industry well.

Top States Utilizing Scaffolding in Construction

The scaffolding industry is key in the U.S. for supporting construction projects. Each state has its own scaffolding rules. This leads to different needs for scaffolding services across the country.

States with Highest Scaffolding Usage Statistics

Recent reports show the top states for scaffolding use are:

- California

- Texas

- Florida

- New York

- Illinois

These states have booming construction sectors. They need scaffolding for high-rise buildings, infrastructure, and commercial projects. Every year, scaffolding accidents cause about 60 deaths and 4,500 injuries in the U.S. construction industry. This highlights the need for safe scaffolding practices and site management.

Factors Contributing to Increased Scaffolding Demand

Several factors drive up scaffolding demand in these states, including:

- Rapid urbanization and population growth

- Strict safety rules and compliance

- New construction materials and methods

- Big infrastructure projects and renovations

“The risk of electrocution from scaffolds near power lines is high. Scaffolds must be at least 10 feet away from overhead lines, sometimes more based on voltage.”

Construction companies are changing with new construction trends. They’re using better scaffolding solutions. This makes the scaffolding industry grow, helping make construction safer and more efficient in the U.S.

Scaffolding Safety Regulations and Compliance

Scaffolding safety is key in the construction world. It’s linked to many workplace injuries and deaths. With 2.3 million workers, or 65% of the construction industry, on scaffolds, strict safety rules are essential. OSHA scaffolding guidelines and state laws help keep workers safe and reduce risks.

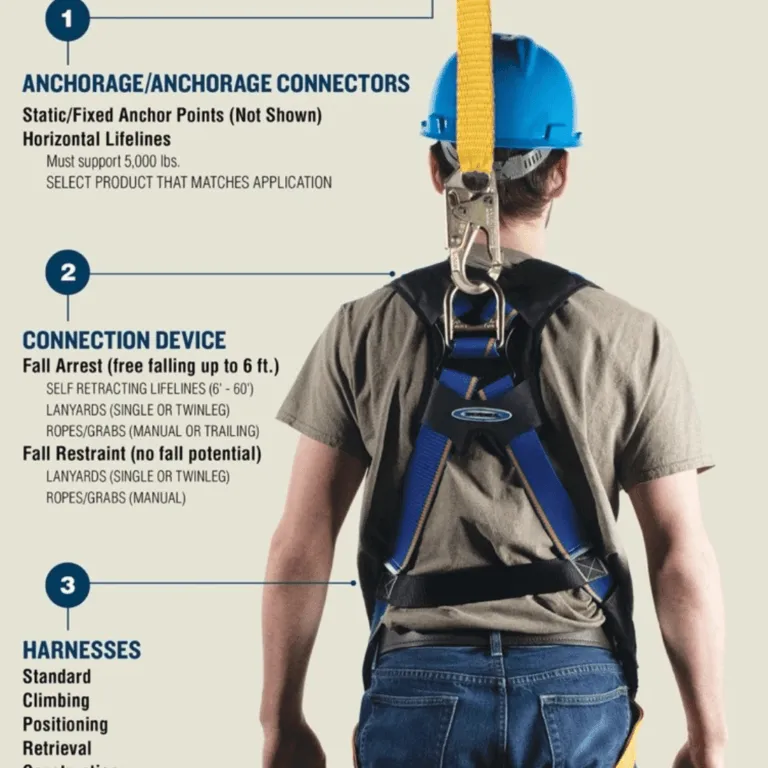

OSHA Guidelines for Scaffolding Usage

OSHA says scaffolds and their parts must hold at least four times the maximum load. Workers over 10 feet up need fall protection. Guardrails should be 38 to 45 inches high on scaffolds over 10 feet tall.

Employers must teach construction worker safety training to all scaffold workers. This includes learning about hazards, how to control them, and using PPE. Important PPE includes hard hats, safety harnesses, and eye protection.

State-Specific Scaffolding Codes and Standards

States also have their own scaffolding rules. For example, Virginia requires a 10-foot clearance from power lines. Companies must know their state’s rules to follow job site safety measures well.

Scaffolding Inspection and Maintenance Protocols

Regular scaffolding inspection protocols and upkeep are vital for safety. A skilled person must check the scaffold before each shift and after any damage. Key checks include:

- Ensuring scaffold footings are level and strong

- Verifying scaffold platforms are fully covered

- Checking scaffolds with a high base ratio are stable

“Scaffolding consistently ranks third on OSHA’s Top Ten List of the most frequently cited standards violations, emphasizing the need for stringent safety measures and compliance.”

Following OSHA rules, state laws, and regular checks can greatly lower scaffolding accident risks. Using temporary work platform best practices and focusing on safety training makes the workplace safer and more compliant.

Advancements in Scaffolding Technology and Materials

The scaffolding industry has seen big changes in technology and materials. Modular platforms are now a big deal, making construction sites more flexible. They can be set up and taken down fast, cutting down on delays.

Fall prevention and protection systems are also key now. New systems make sure workers are safe when they’re high up. These include safety nets, guardrails, and personal fall arrest systems.

New materials are changing scaffolding too. Lightweight but strong alloys like aluminum and titanium are used. They make scaffolding strong but easy to move around.

The global scaffolding market is growing fast. It was worth USD 13,830.44 million in 2022 and is expected to hit USD 19,651.91 million by 2028. This growth is because of the need for better and safer construction methods.

The scaffolding industry is getting better with new tech and materials. This means construction can be done faster and safer. Companies can work more efficiently and keep workers safe.

Which States Use More Scaffolding and Why

Scaffolding use varies across the United States. States with more construction, strict safety rules, and urban growth use more scaffolding. Economic factors, like construction investments and sector growth, also play a role.

Comprehensive Analysis of Scaffolding Usage by State

The scaffolding market in the U.S. is expected to grow over the next five years. But, scaffolding use differs among states. For example, New York has strict Scaffold Law, leading to more accidents and higher insurance costs.

States without such laws see better safety and more investment. This shows how laws affect scaffolding use.

Scaffolding contractors offer various services, like scaffolding systems and shoring. They often work near big cities to meet demand. Contractors compete on price, giving buyers many options.

Economic and Regulatory Factors Driving Scaffolding Adoption

Economic and regulatory factors shape scaffolding demand. The federal government’s increased infrastructure spending will boost demand. Demographics, macroeconomics, and policies also impact the industry.

“An estimated 65% of construction workers perform their duties on or from a scaffold, often at extreme heights. Slip-and-fall accidents on scaffolds can be fatal, and many workers die yearly due to falls from scaffolds.”

OSHA’s Safety Requirements for Scaffolding mandate proper training and safety gear. States with strict safety rules use more scaffolding to protect workers.

Case Studies of High-Scaffolding Usage States

New York is a prime example of high scaffolding use. Its labor laws and urban construction drive demand. The NYC Building Code also requires regular scaffolding checks.

California, Texas, and Florida also see a lot of scaffolding use. Their large populations, urban growth, and infrastructure investments drive demand.

Conclusion

The scaffolding industry is key to the construction world, keeping workers safe and helping projects get done across the U.S. With more new buildings and roads needed, the scaffolding industry outlook looks good. But, how much scaffolding is used changes a lot from state to state. This depends on building projects, rules, and how crowded the areas are.

Keeping construction sites safe is a big deal. Workers need to know the latest OSHA rules and local laws. Following safety standards and checking scaffolding often helps keep everyone safe.

The scaffolding world is changing, thanks to new tech and materials. This means better safety, work flow, and following rules. By knowing what makes scaffolding use different in each state, the industry can keep growing. And it can do this while making sure workers are safe on every job site.

FAQ

What is the current market size and revenue of the scaffolding industry?

Which companies lead the scaffolding industry?

What factors influence scaffolding usage across states?

Which states have the highest scaffolding usage statistics?

What are the key scaffolding safety regulations and compliance requirements?

How have advancements in scaffolding technology and materials impacted the industry?

What factors contribute to higher scaffolding usage in certain states?